Veterans and civilians weigh election impact on homebuying decisions, with varying perspectives on timing and economic outlook.

The presidential election this fall is weighing on the minds of many would-be homebuyers.

Sixty percent of Veterans and civilians who plan to buy in the next three years say the 2024 election is a factor in their purchasing timeline, according to Veterans United Home Loans’ most recent Veteran Homebuying Report, a quarterly national survey of Veterans, service members and civilians with near-term homebuying plans.

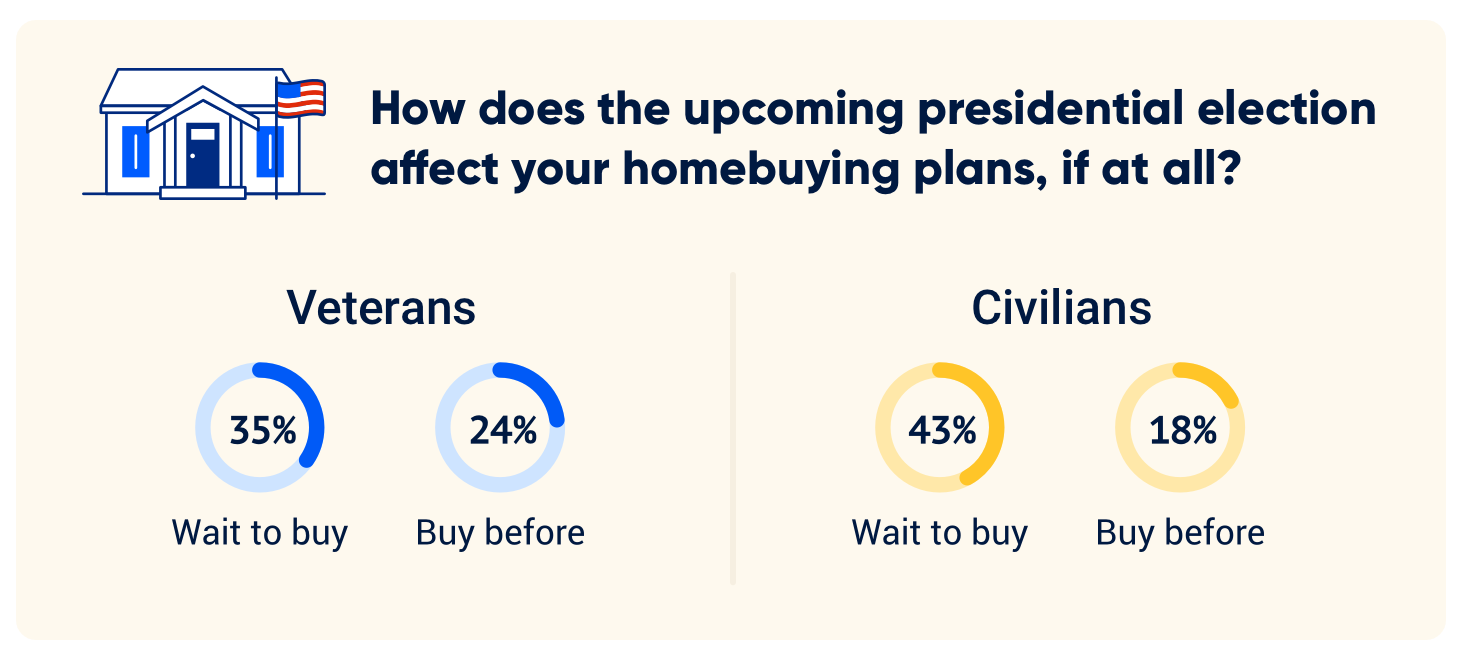

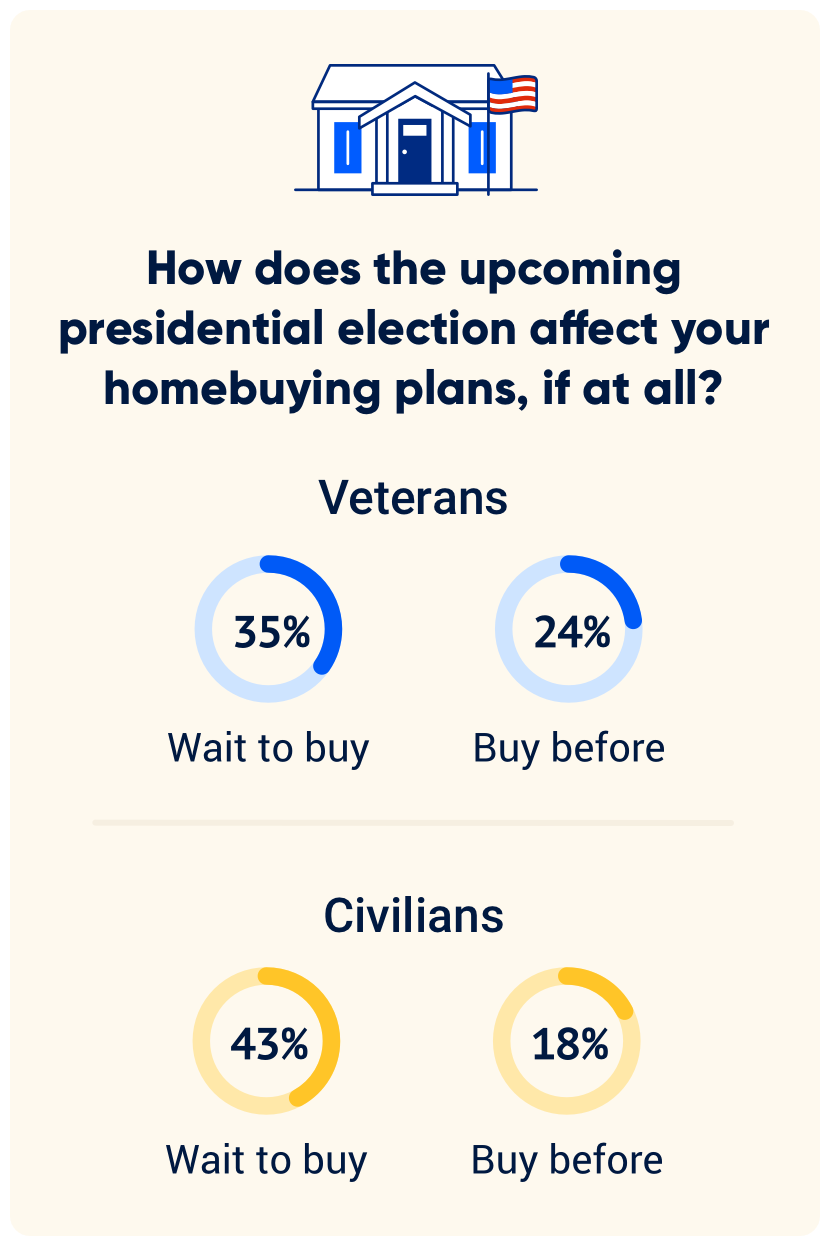

More civilians think it’s better to wait until after the election to buy a home than Veterans, while more Veterans favor buying before Election Day.

“The upcoming election is clearly weighing on the minds of prospective homebuyers,” said Chris Birk, vice president of mortgage insight at Veterans United. “Americans are considering the potential impacts of political changes on the economy and housing market, leading many to adjust their buying timelines accordingly.”

Election and Buying Plans

Here’s a look at how the election question breaks down between Veterans and civilians:

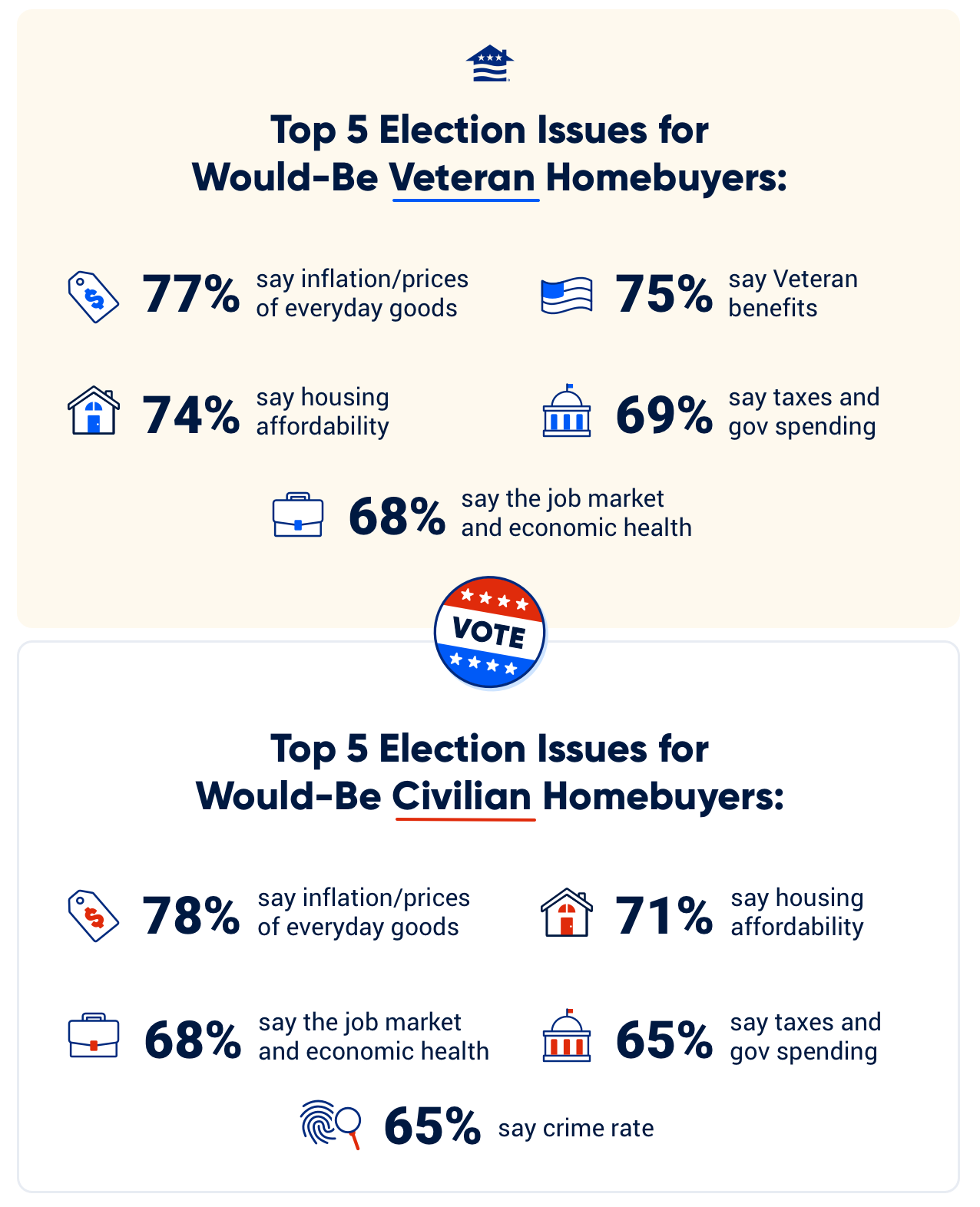

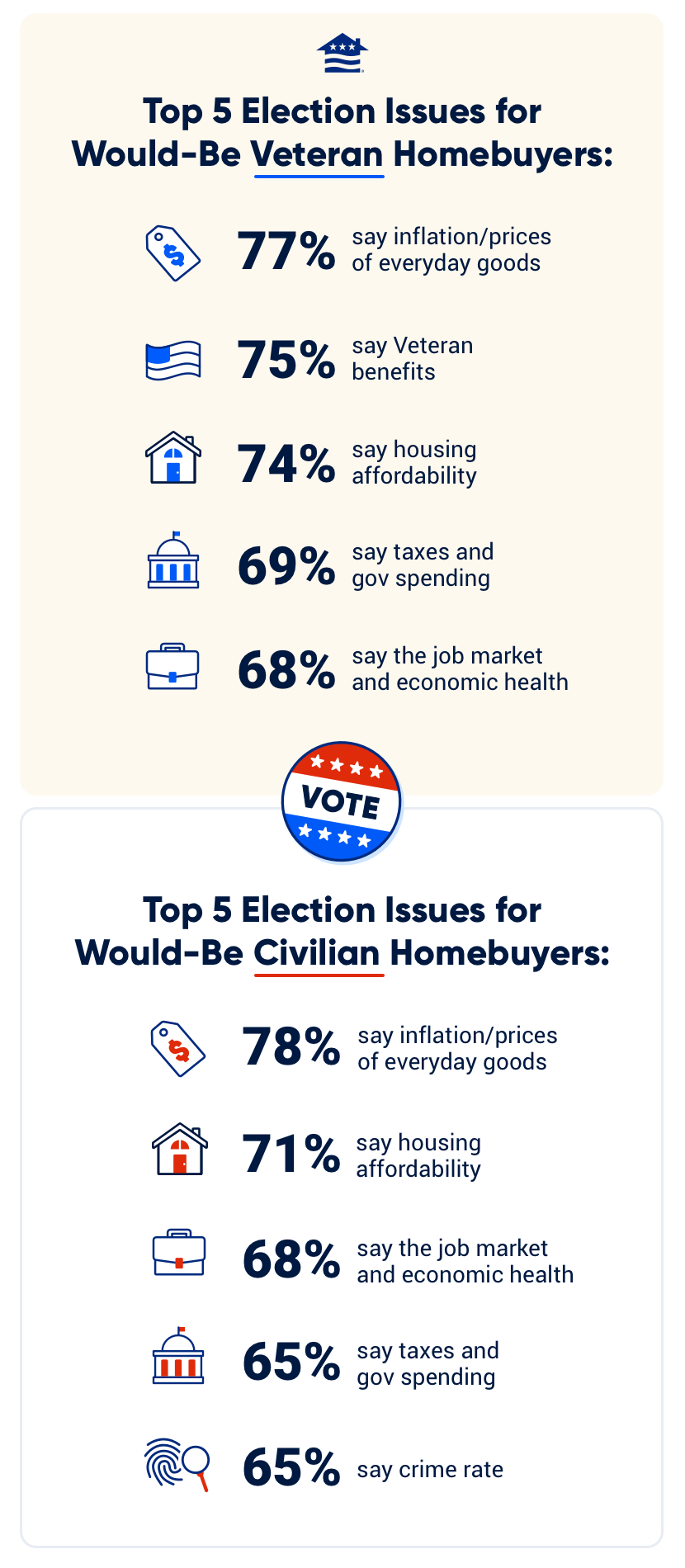

When it comes to key election issues, prospective Veteran and civilian homebuyers are mostly in lockstep. A focus on Veteran benefits is the only real outlier between the two groups.

But there’s considerable daylight between Veterans and civilians when it comes to optimism about the election outcome.

Prospective Veteran buyers concerned about housing affordability and government spending were significantly more pessimistic about the election outcome than civilians who rated the same issues as important.

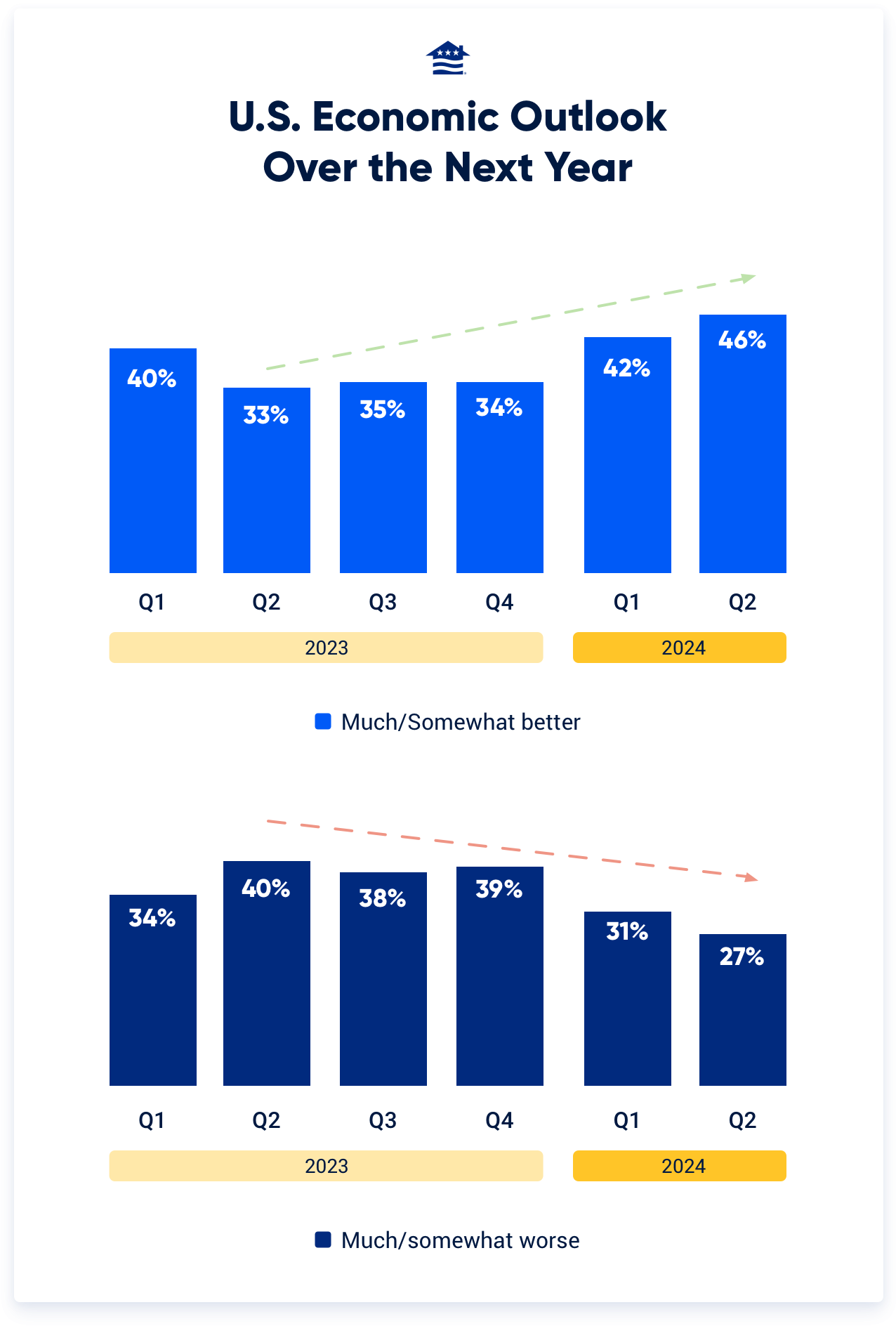

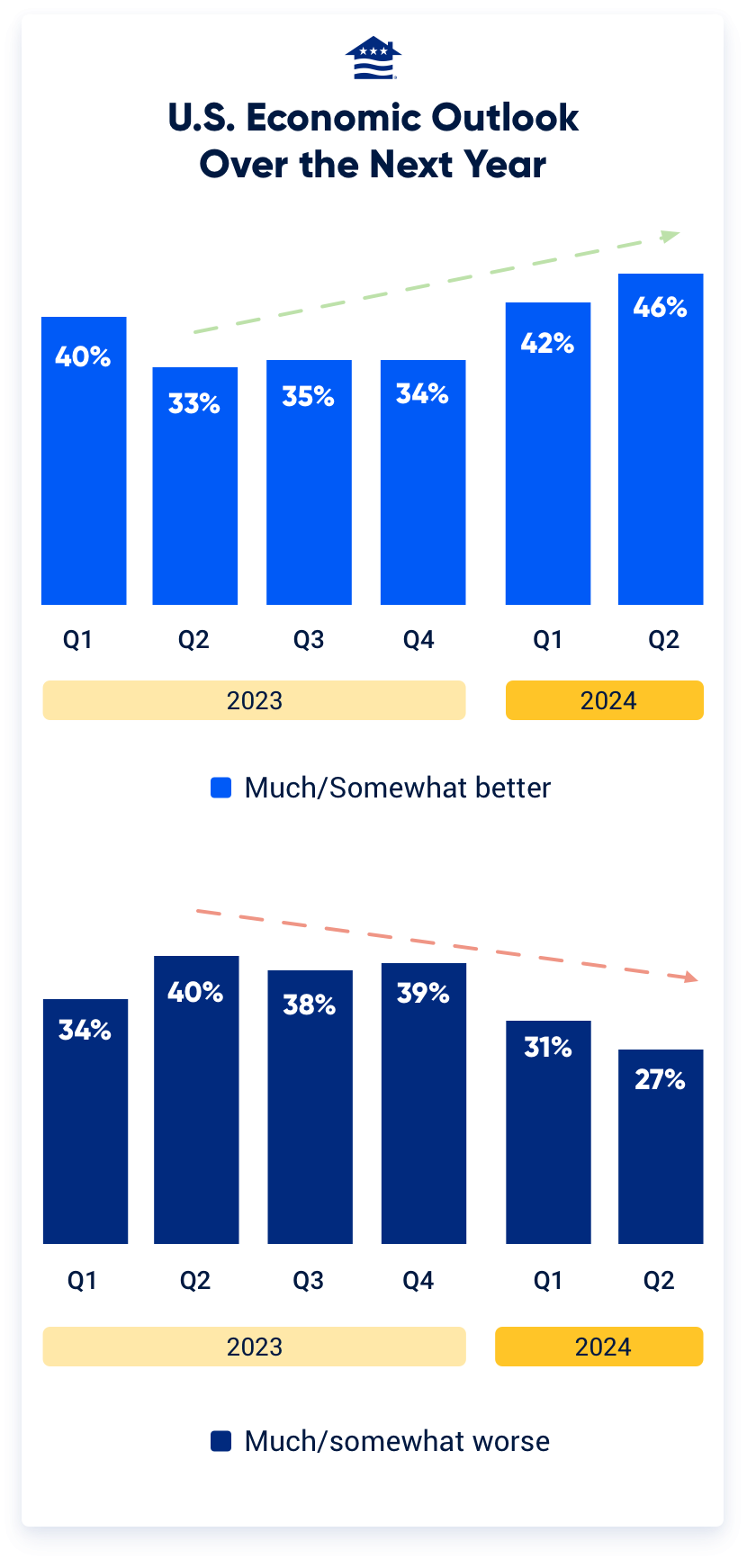

Rising Economic Optimism

Election uncertainty aside, the second quarter survey results highlight a growing economic optimism among Veterans and service members.

Nearly half (46%) think the economy will be better off over the next year, a four-point jump from the first quarter and the highest figure in the six-quarter history of the survey. That’s also a slightly higher proportion than civilians (42%).

Meanwhile, pessimism about the economic outlook has trended downward over the same span.

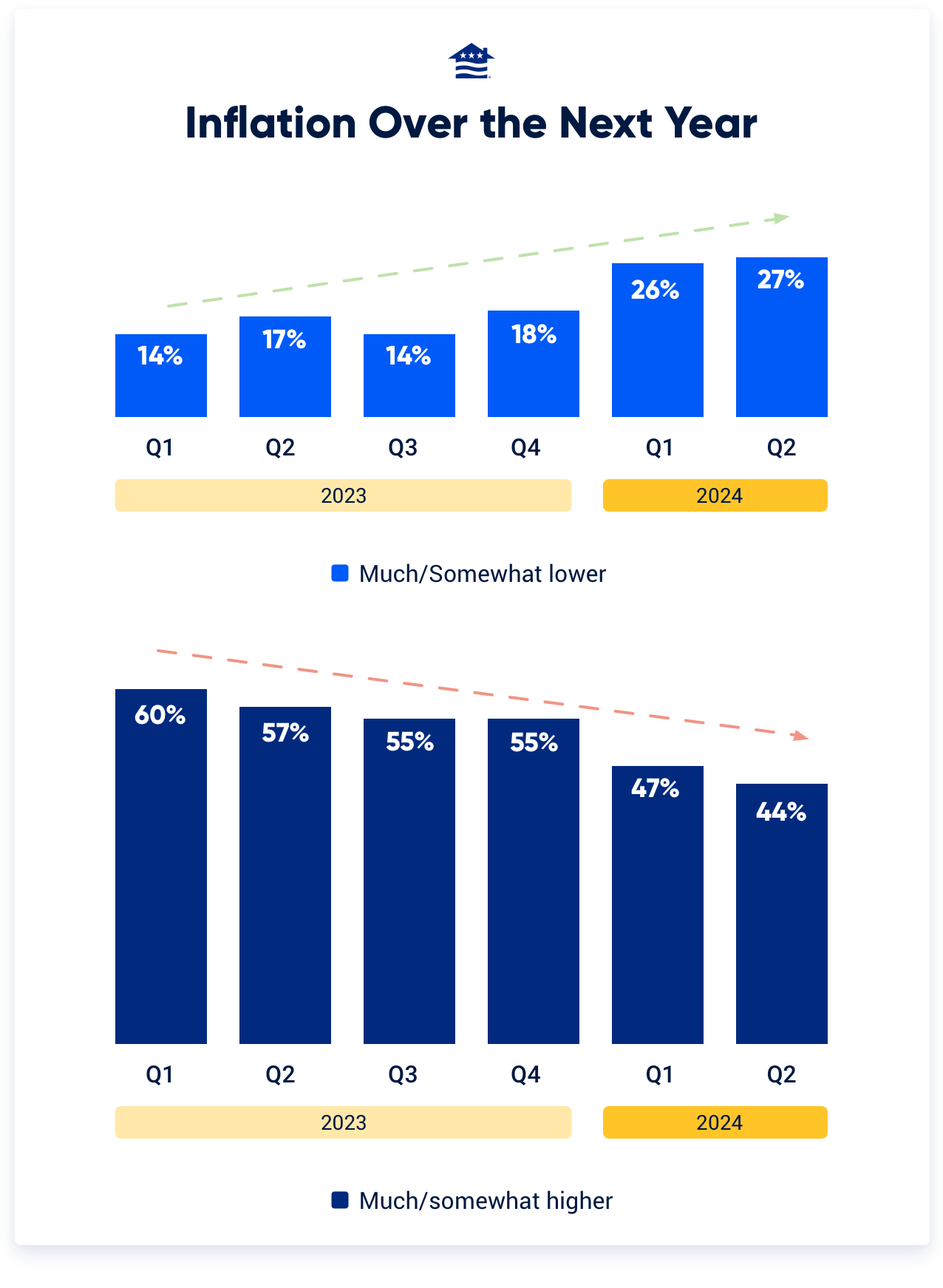

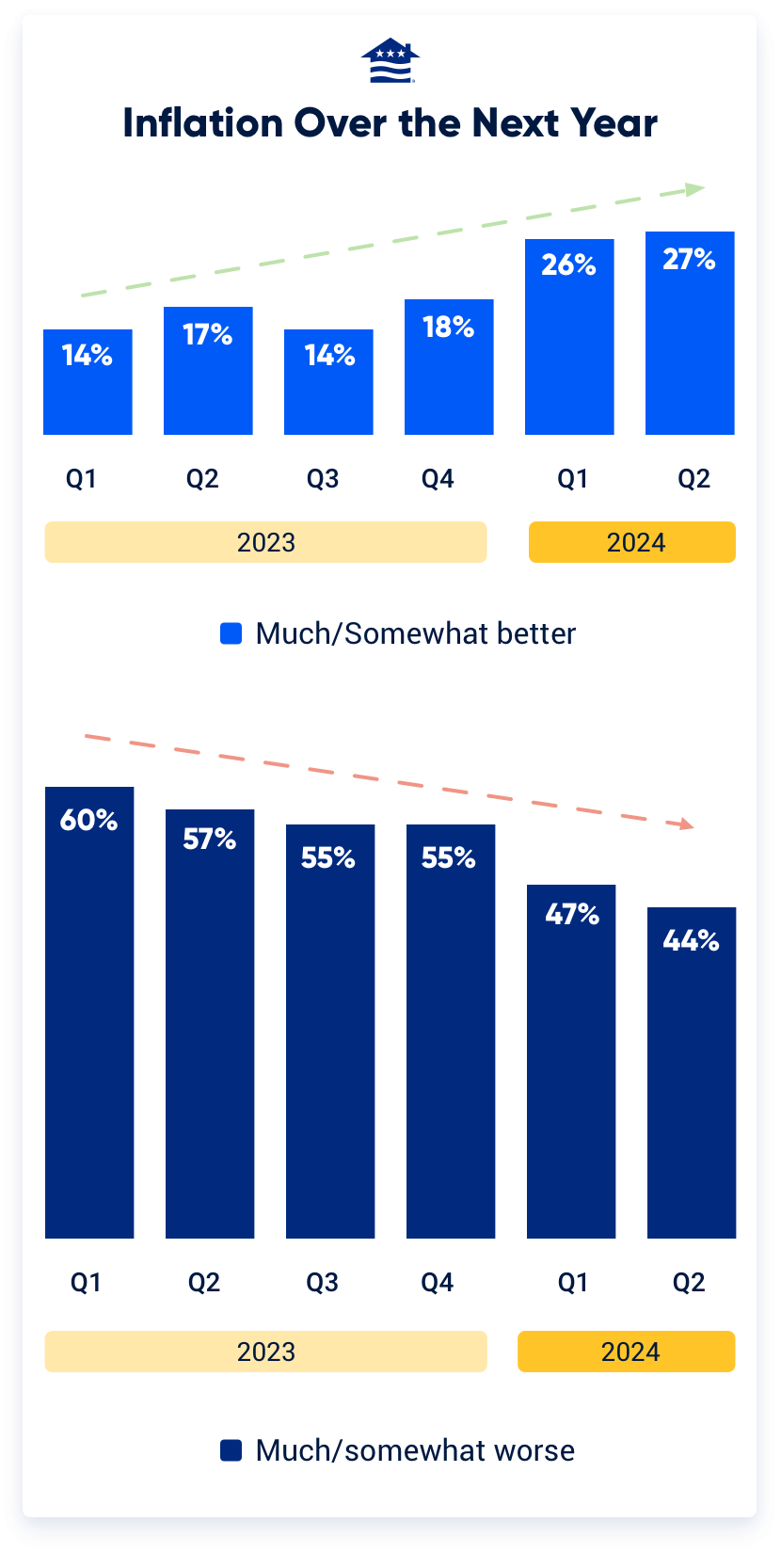

There’s also continued optimism that the Federal Reserve will get inflation under control in the next 12 months.

When it comes to personal finances, more Veterans (46%) feel at ease than civilians (43%). More Veterans than civilians feel they’ll be better off financially in the coming year, too.

Nearly 6-in-10 Veterans (57%) said they felt capable in their ability to close a home loan right now, a two-point jump from the first quarter and the highest percentage in the last year and a half. Increased Veteran buyer confidence could be partially attributed to the ability to use the VA loan benefit.

But it isn’t all positive. More Veterans are feeling unease about their personal financial plans compared to the first quarter while spending more money now than they did a year ago.

Buying Plans and Trade-Offs

Higher mortgage rates and home prices remain the top two barriers to homebuying for Veterans and service members. But most Veterans are still bullish on buying.

In all, 67% of Veteran respondents plan to buy a home in the next three years, a slight uptick from the first quarter and the highest percentage in survey history. The rate and price environment is leading some Veterans to push back their plans – 40% of Veterans said they plan to buy in the next six months, down from 42% in the previous quarter.

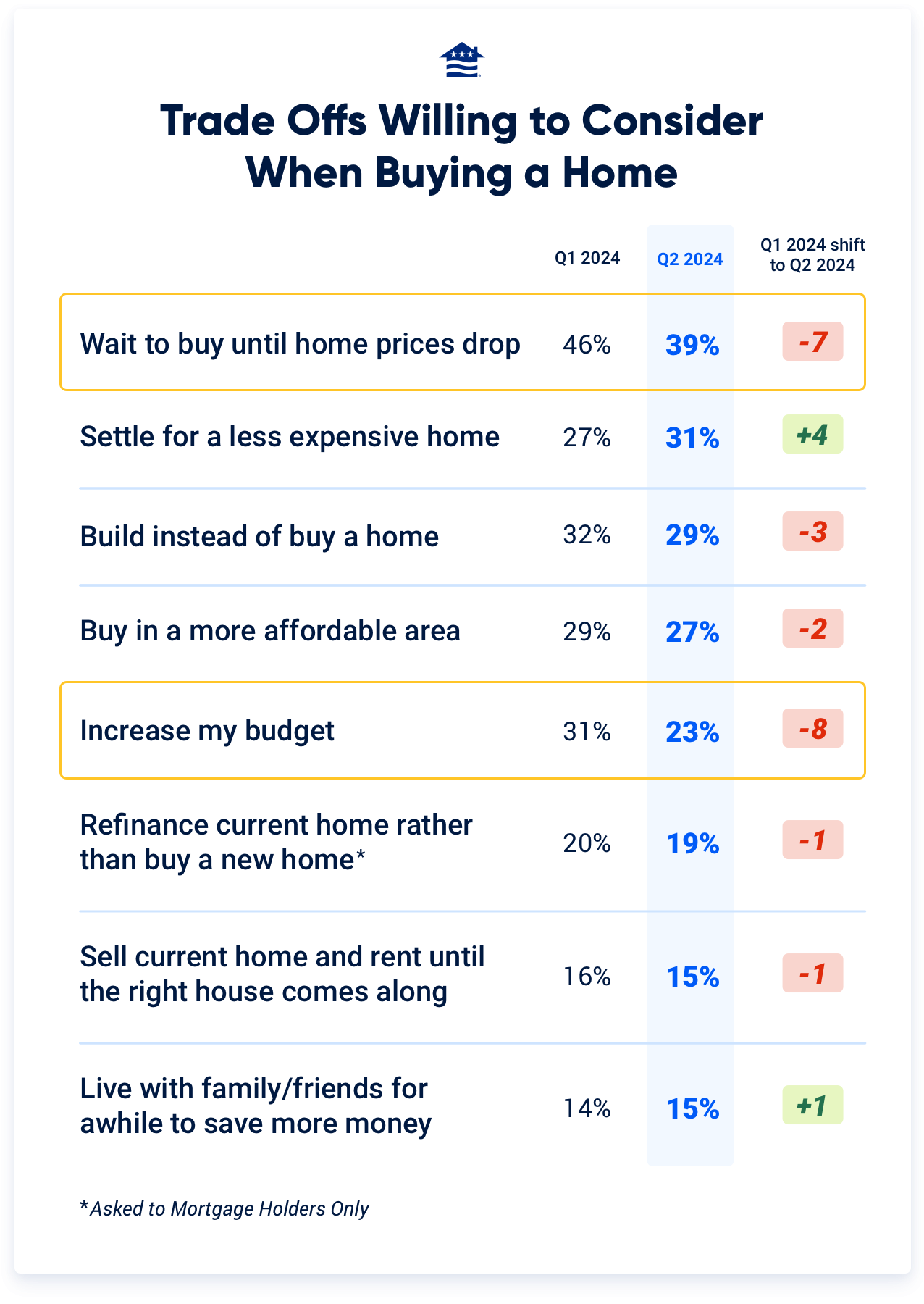

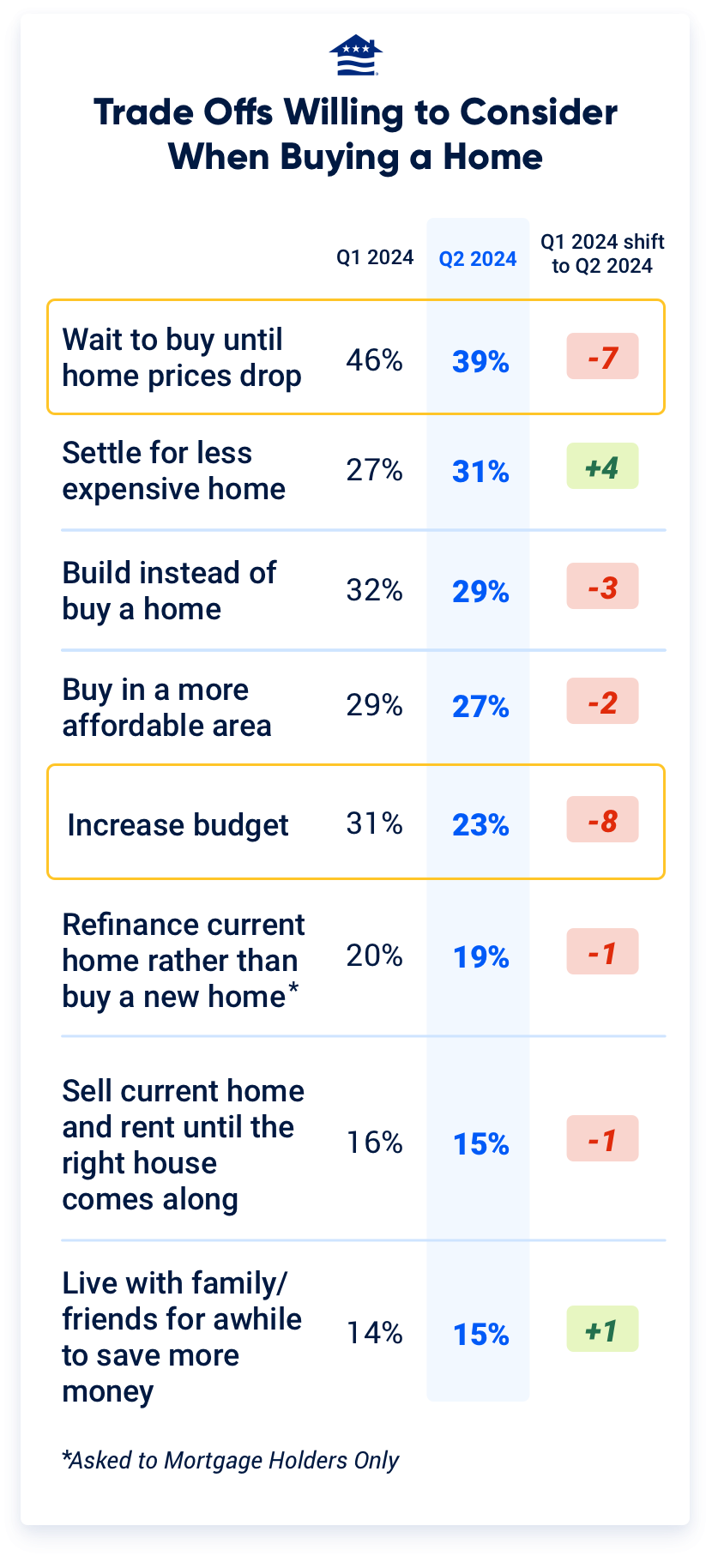

Expectations about lingering high home prices are also impacting how Veterans think about trade-offs that come with waiting to purchase.

The second quarter survey found future buyers are less willing to consider waiting to buy or to boost their budget to get what they want. At the same time, more Veterans are willing to settle for a cheaper house even if it doesn’t have everything they want.

“More Veterans seem to be settling into an expectation that higher rates and home prices are sticking around, which makes the trade-off of waiting to buy increasingly less appealing,” Birk said. “Buying now and building equity, even if they don’t get everything they want in a home, is a growing sentiment among Veterans and service members wary of an uncertain future when it comes to rates and prices.”

Methodology

On behalf of Veterans United, data and research firm Sparketing conducted an online survey of 930 Veterans, service member and civilians from June 3-18, 2024.

We surveyed service members from both the active and Reserve components, as well as Veterans.

For the purpose of this survey, active duty military are full-time members of the Armed Forces. The Reserve component includes drilling National Guardsmen and Reservists. Veterans are military members who have been discharged or retired from the service and no longer serve in uniform.

Related Posts

-

How to Make an Offer on a HouseOnce you’ve found the right home, you need to know how to put together a purchase offer. Learn tips for putting an offer on a house with a VA loan.

How to Make an Offer on a HouseOnce you’ve found the right home, you need to know how to put together a purchase offer. Learn tips for putting an offer on a house with a VA loan. -

4 Tax Breaks for Homeowners for 2025Owning a home not only offers a sense of security but can also lead to significant tax savings. Discover the top tax deductions and credits available to homeowners so you can enjoy the perks of homeownership – even at tax time.

4 Tax Breaks for Homeowners for 2025Owning a home not only offers a sense of security but can also lead to significant tax savings. Discover the top tax deductions and credits available to homeowners so you can enjoy the perks of homeownership – even at tax time.