- The VA does not offer reverse mortgages, though other options may be marketed to Veterans.

- Reverse mortgages are available to homeowners 62 and older, providing cash without monthly mortgage payments but reducing home equity over time.

- A VA Cash-Out refinance is a VA-backed alternative that allows eligible Veterans to access their home equity.

If you’re a Veteran or a surviving spouse, you may have seen ads for VA reverse mortgage loans and wondered if you could benefit from this process to tap into your home’s equity.

Here are some important facts you need to know before making any decisions.

What is a Reverse Mortgage?

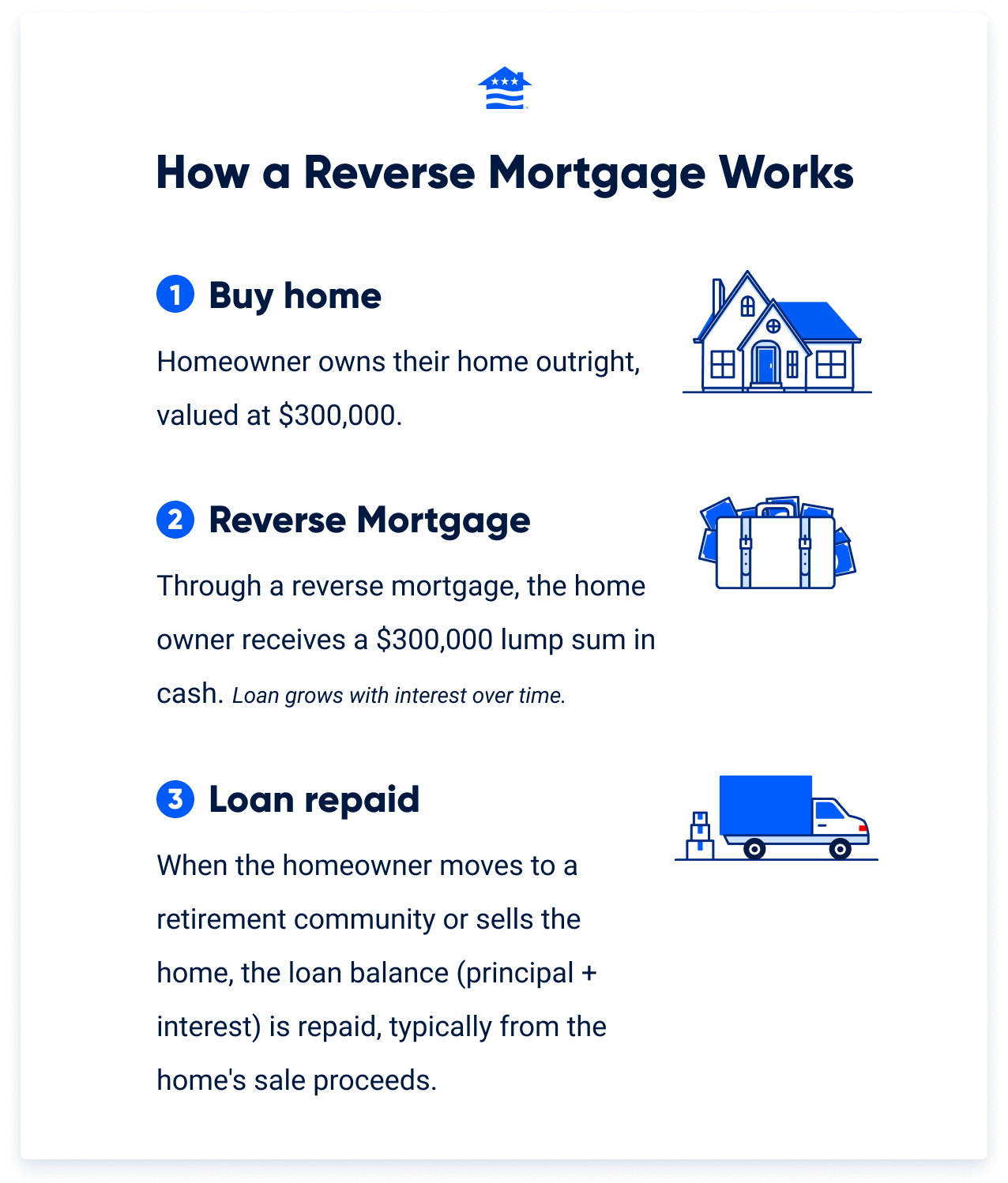

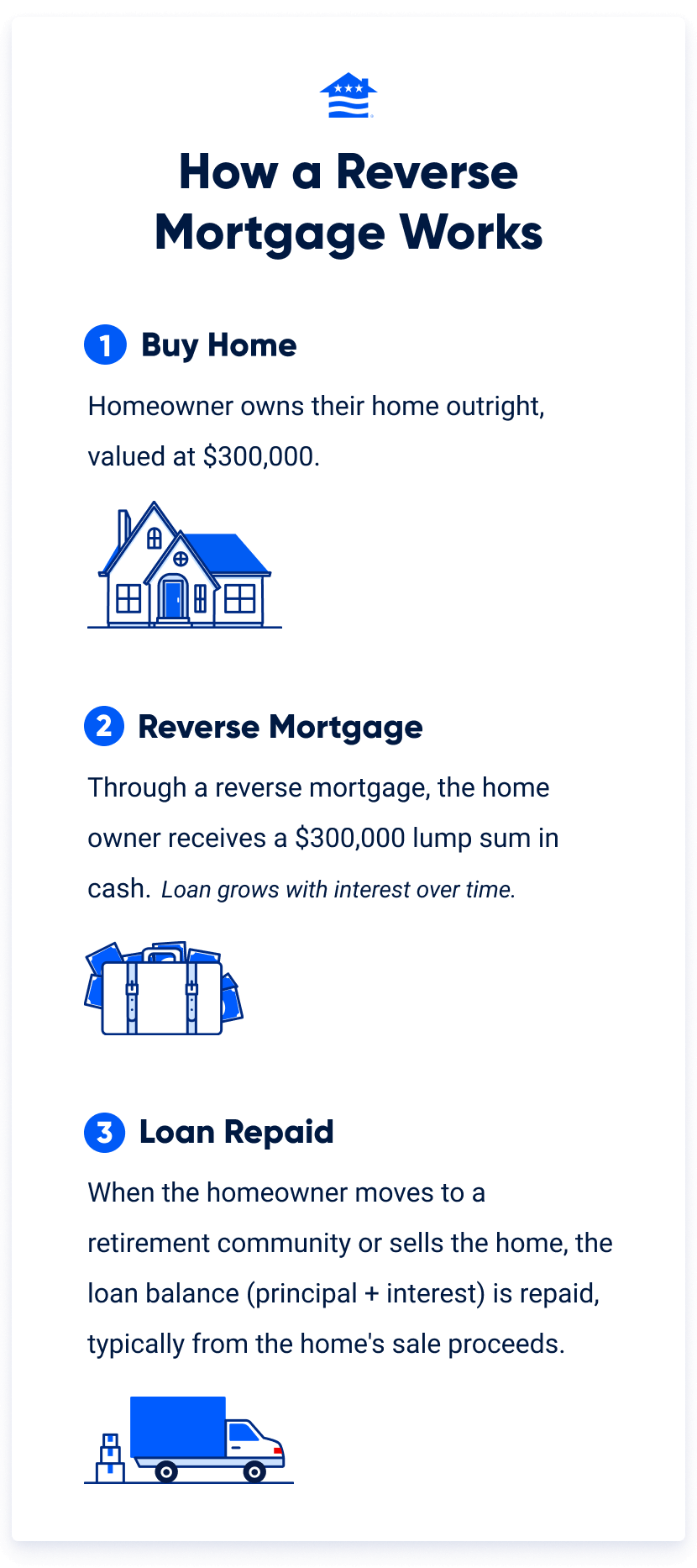

A reverse mortgage is a type of loan that is available to borrowers aged 62 and older who have significant home equity. To qualify, you must own your home outright or have substantial equity, use the home as your primary residence and complete a HUD-approved counseling session.

Most reverse mortgages are Home Equity Conversion Mortgages (HECMs), which are FHA-insured. Because of this, borrowers are required to pay certain FHA-related costs, including mortgage insurance premiums.

With a reverse mortgage, you do not make monthly mortgage payments. Instead, the loan balance plus interest comes due when the borrower sells the home, permanently moves out, such as into a nursing home, or passes away.

Borrowers must still pay property taxes, homeowners' insurance and the costs associated with maintaining the home. The interest is added to the balance each month, causing the total amount owed to grow over time.

For HECMs, eligible surviving spouses may be able to remain in the home even after the borrower passes away, as long as they meet certain conditions, such as being listed on the loan documents and continuing to pay property taxes, insurance and maintenance costs.

There are protections in place to ensure that the loan balance won't exceed the value of the home, and if it does, neither the borrower nor the borrower's estate will be held responsible for paying the excess balance. However, heirs do have options: they can choose to repay the loan balance (or 95% of the home's appraised value, whichever is less) and keep the home, or they can sell the home to satisfy the debt.

This can be an attractive proposition for older homeowners who need an influx of cash and don’t want to worry about making monthly payments. It can also be ideal for those who want to eliminate their current mortgages while staying in their homes.

Does the VA Offer Reverse Mortgages?

You may have seen ads that imply the availability of “no payment” reverse mortgages for Veterans. But these ads are slightly misleading. The VA does not offer reverse mortgages or provide approval for any VA reverse mortgage program.

However, if you have a home financed with a VA loan, you may still be able to take out a reverse mortgage. It would be a standard reverse mortgage, such as an FHA-backed HECM, not a VA-backed loan.

Some lenders market reverse mortgages toward Veterans, but these are not part of the VA loan program.

Alternatives to the VA Reverse Mortgage

If you’re looking for a way to tap into your home equity and you want to take advantage of a VA loan’s competitive terms, a VA Cash-Out refinance loan may be a viable alternative to a reverse mortgage. This option allows you to refinance your current mortgage with a new VA loan.

The new mortgage will come with its own terms and a higher payoff balance than what you owe on your current loan. When you close on the loan, you’ll receive the excess amount as a lump sum of cash.

Interest rates on reverse mortgages are typically higher than those for VA Cash-Out refinances. Additionally, because reverse mortgage interest isn't paid monthly but instead compounds and adds to your loan balance, the total amount owed can grow significantly over time. In contrast, a VA Cash-Out refinance offers competitive interest rates, and making regular monthly payments prevents your debt from growing.

Pros and Cons of a VA Cash-Out Refinance

When deciding whether a VA Cash-Out refinance is right for you, there are some important pros and cons to consider. Here’s a look at a few of the most important.

| Pros | Cons |

|---|---|

| Borrow up to 100% of your home’s value | Monthly mortgage payments are still required |

| Receive the difference as a lump sum of cash at closing | The VA Funding Fee is required unless you qualify for an exemption |

| Continue building equity as you repay the loan | Must meet credit, DTI and occupancy requirements |

| VA loan guaranty reduces lender risk and helps with competitive loan terms | Requires a VA appraisal |

Pro: Access to Cash

A VA Cash-Out refinance allows you to borrow against your home equity and take the difference as a lump sum of cash at closing. The VA allows qualified Veterans to refinance up to 100% of the home’s value, though most lenders cap this at 90%.

For example, say your home is valued at $300,000, and your remaining mortgage balance is $100,000. 90% of $300,000 equals $270,000, leaving about $170,000 in potential cash-out funds.

- 90% of $300,000 = $270,000

- $270,000 - $100,000 current balance = $170,000 available as cash

Closing costs and the VA Funding Fee can be paid from the proceeds of the refinance as long as you stay within the lender’s loan-to-value limits.

The money you receive from a VA Cash-Out refinance is considered a loan, not income, which means it is not taxable.

Pro: Ability to Build Equity

As you make payments to your lender, you will continue to build equity in your home. This can increase your profits when you sell.

Con: Closing Costs and Fees

Borrowers are required to pay an upfront VA Funding Fee that ranges between 2.15% and 3.3% of the loan amount. You must also pay standard closing costs, which usually range between 3% and 5% of the loan amount.

However, Veterans with a qualifying VA disability rating may be eligible to have the funding fee waived, just as they would when buying a home with their VA benefit. Be sure to check with your Loan Officer to confirm whether your funding fee is waived under VA guidelines or included in the loan.

Many borrowers choose to roll these costs into the new loan, which reduces the amount of cash they receive at closing but keeps out-of-pocket expenses low.

Con: Eligibility Requirements

You must be eligible for a VA loan and meet your lender’s requirements regarding your credit score and debt-to-income ratio (DTI). You also must have a home appraisal, meet VA and lender credit requirements and occupy the home as your primary residence.

Con: Monthly Payments

A cash-out refinance still requires you to make monthly payments to your lender. If your goal is to eliminate your mortgage payments, this strategy will not work.

Pros and Cons of Reverse Mortgages

Reverse mortgages can be beneficial for some homeowners, but they also have some potential drawbacks. Take a look at these important pros and cons.

| Pros | Cons |

|---|---|

| No monthly mortgage payments while living in the home | Reduces equity and inheritance potential |

| Flexible cash access (lump sum, monthly payments or line of credit) | Must continue paying property taxes, insurance and home upkeep |

| Protections ensure you won’t owe more than your home’s value | FHA mortgage insurance adds upfront (1.75%) and annual (0.55%) costs |

Pro: No Monthly Mortgage

When you take out a reverse mortgage, you no longer have to worry about making monthly mortgage payments or the possibility of the lender foreclosing on your home, as long as you meet your obligations to pay property taxes and insurance and maintain the property.

Pro: Flexible Options for Access to Cash

A reverse mortgage allows you to access your home's equity as a lump sum, monthly payments or a line of credit.

Just like a cash-out refinance, funds from a reverse mortgage are treated as loan advances, not income. This means the money is not subject to taxation.

Con: Equity Depletion

Each payment you receive from your reverse mortgage depletes the equity in your home, lowering the amount you could leave as an inheritance.

Con: Mortgage Insurance

The FHA requires mortgage insurance for reverse mortgages. This includes an upfront cost of 2% of the total amount borrowed and an annual mortgage insurance premium of 0.5% of the outstanding loan balance.

Can You Refinance a Reverse Mortgage With a VA Loan?

If you already have a reverse mortgage, it is possible to refinance it. You may want to do this to change the existing loan terms or to switch to a different type of mortgage. Refinancing back to a traditional mortgage can allow you to preserve the remaining equity in your home or avoid having to sell the home to pay off the loan.

If you are eligible for a VA loan, meet all VA and lender requirements and are living in the home as your primary residence, you may be able to VA refinance your reverse mortgage.

How We Maintain Content Accuracy

Our mortgage experts continuously track industry trends, regulatory changes, and market conditions to keep our information accurate and relevant. We update our articles whenever new insights or updates become available to help you make informed homebuying and selling decisions.

Current Version

Mar 4, 2026

Written ByMitch Casteel

Reviewed ByDon Wilson

Updated content for accuracy and added infographic. Article fact checked by underwriter reviewer Don Wilson.

Veterans United often cites authoritative third-party sources to provide context, verify claims, and ensure accuracy in our content. Our commitment to delivering clear, factual, and unbiased information guides every piece we publish. Learn more about our editorial standards and how we work to serve Veterans and military families with trust and transparency.

Related Posts

-

VA Renovation Loans for Home ImprovementVA rehab and renovation loans are the VA's answer to an aging housing market in the United States. Here we dive into this unique loan type and the potential downsides accompanying them.

VA Renovation Loans for Home ImprovementVA rehab and renovation loans are the VA's answer to an aging housing market in the United States. Here we dive into this unique loan type and the potential downsides accompanying them. -

Pros and Cons of VA LoansAs with any mortgage option, VA loans have pros and cons that you should be aware of before making a final decision. So let's take a closer look.

Pros and Cons of VA LoansAs with any mortgage option, VA loans have pros and cons that you should be aware of before making a final decision. So let's take a closer look.